Integrating ATLAND products into local territories and challenges

As a multi-disciplinary player in the real estate sector, ATLAND operates throughout France and across Europe. ATLAND strives to balance the demands of its business with environmental responsibility by adapting its management practices to local challenges, whether in development or asset management. The Group ensures that its products are environmentally respectful, resilient, and beneficial to local stakeholders.

ATLAND faces different biodiversity challenges in both its management and development activities. Managing an asset requires consideration of ecological aspects and the treatment of existing ecosystem services.

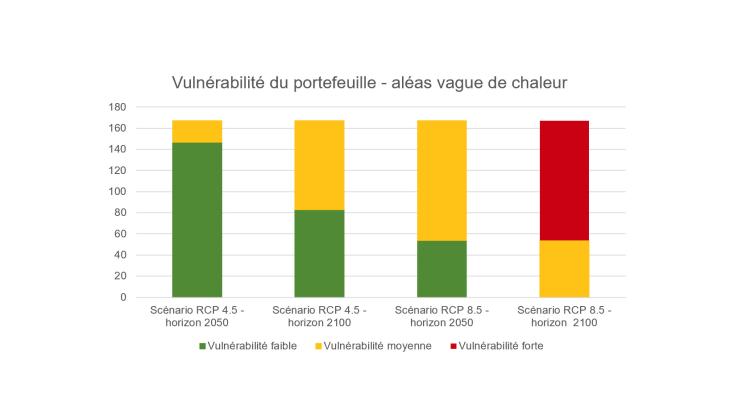

At the same time, the consequences of climate change are increasingly affecting the entire real estate sector. French real estate assets are exposed to growing climate risks: heatwaves, floods, wildfires, landslides, etc. For several years, ATLAND has undertaken extensive climate risk mapping and has assessed the exposure of most of its managed portfolio and new buildings.

of the assets managed by Atland Voisin are analyzed through ESG criteria

(compared to 79% in 2023)

of real estate development projects under design include calculations for the Biotope Surface Coefficient (CBS) and the level of land artificialization

of ATLAND’s development projects under design undergo climate risk exposure studies

Approximately 90% of the ESG-analyzed assets managed by Atland Voisin have undergone climate risk mapping (excluding MyShare)

of tertiary operations and around 50% of residential operations (in terms of housing units) are certified: NF Habitat HQE, Bee+, BREEAM

4 ISR-labeled SCPI funds:

Épargne Pierre, Épargne Pierre Europe

MyShare SCPI, MyShareEducation